Compute the Balance in Problem 28 Again Assuming That

Analyzing and Recording Transactions

17 Fix a Trial Balance

Once all the monthly transactions take been analyzed, journalized, and posted on a continuous mean solar day-to-day basis over the accounting catamenia (a month in our instance), we are ready to offset working on preparing a trial balance (unadjusted). Preparing an unadjusted trial rest is the fourth step in the bookkeeping bicycle. A trial balance is a list of all accounts in the general ledger that take nonzero balances. A trial rest is an important step in the accounting process, because information technology helps place any computational errors throughout the first 3 steps in the cycle.

Note that for this step, we are considering our trial balance to be unadjusted. The unadjusted trial residuum in this section includes accounts earlier they have been adjusted. As you lot see in step 6 of the accounting bicycle, we create some other trial balance that is adapted (see The Adjustment Process).

When amalgam a trial residual, we must consider a few formatting rules, akin to those requirements for financial statements:

- The header must contain the name of the company, the characterization of a Trial Balance (Unadjusted), and the date.

- Accounts are listed in the accounting equation order with assets listed commencement followed past liabilities and finally disinterestedness.

- Amounts at the peak of each debit and credit cavalcade should have a dollar sign.

- When amounts are added, the final effigy in each column should be underscored.

- The totals at the end of the trial balance need to take dollar signs and be double-underscored.

Transferring information from T-accounts to the trial balance requires consideration of the terminal balance in each business relationship. If the final balance in the ledger account (T-account) is a debit balance, y'all will record the total in the left cavalcade of the trial balance. If the final balance in the ledger account (T-account) is a credit balance, you volition record the total in the correct column.

In one case all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to run across if the figures in each cavalcade match each other. The last full in the debit cavalcade must be the same dollar amount that is determined in the concluding credit column. For example, if you determine that the last debit balance is $24,000 then the terminal credit residue in the trial balance must also exist $24,000. If the 2 balances are non equal, in that location is a mistake in at least i of the columns.

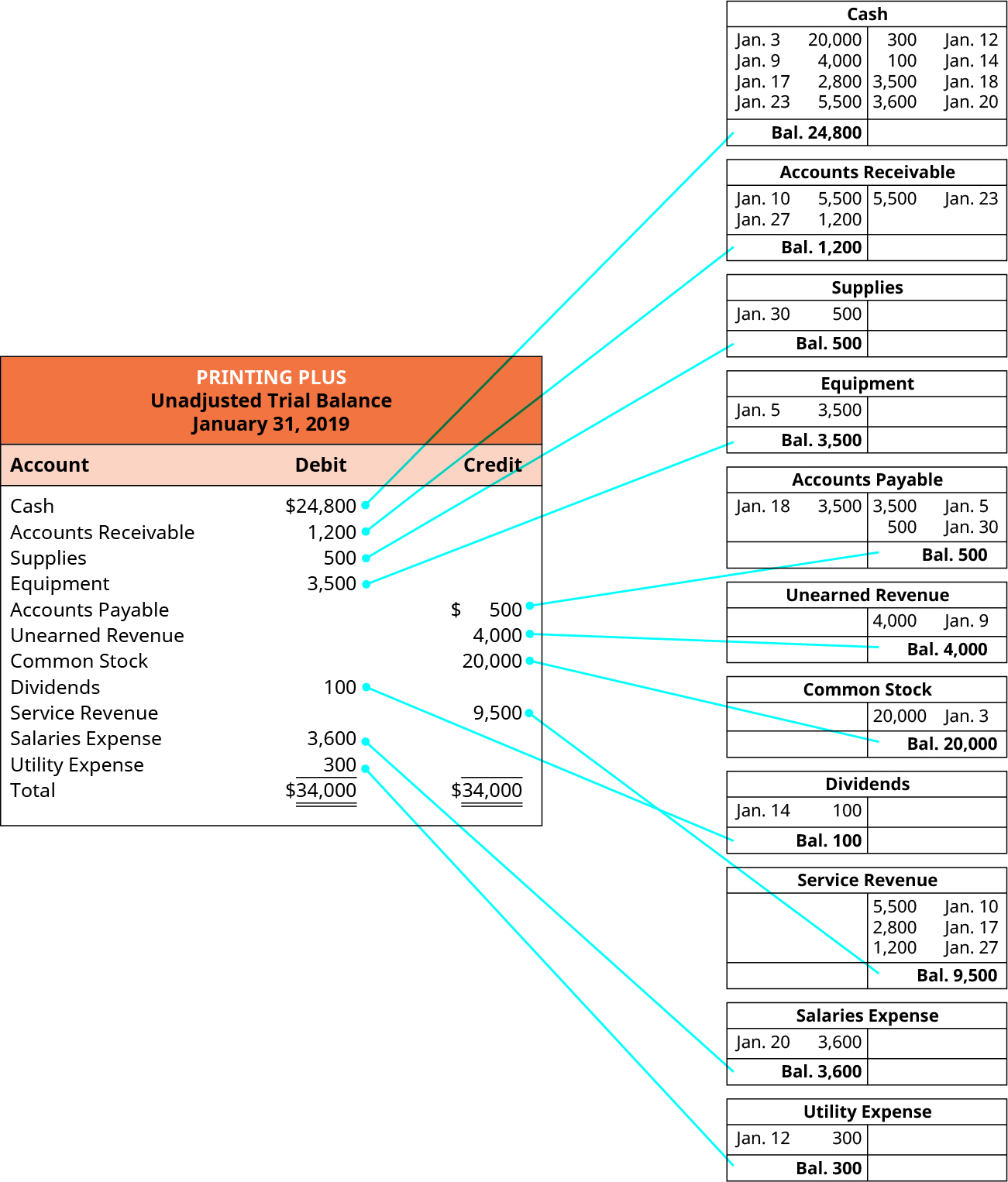

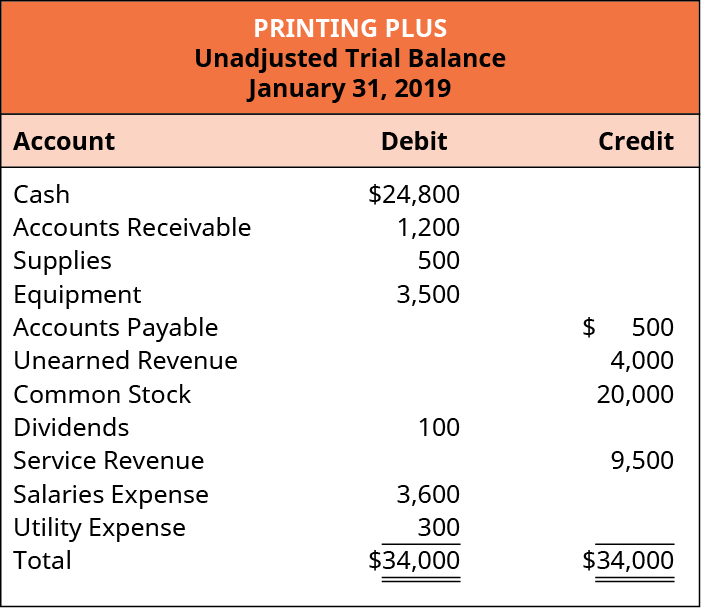

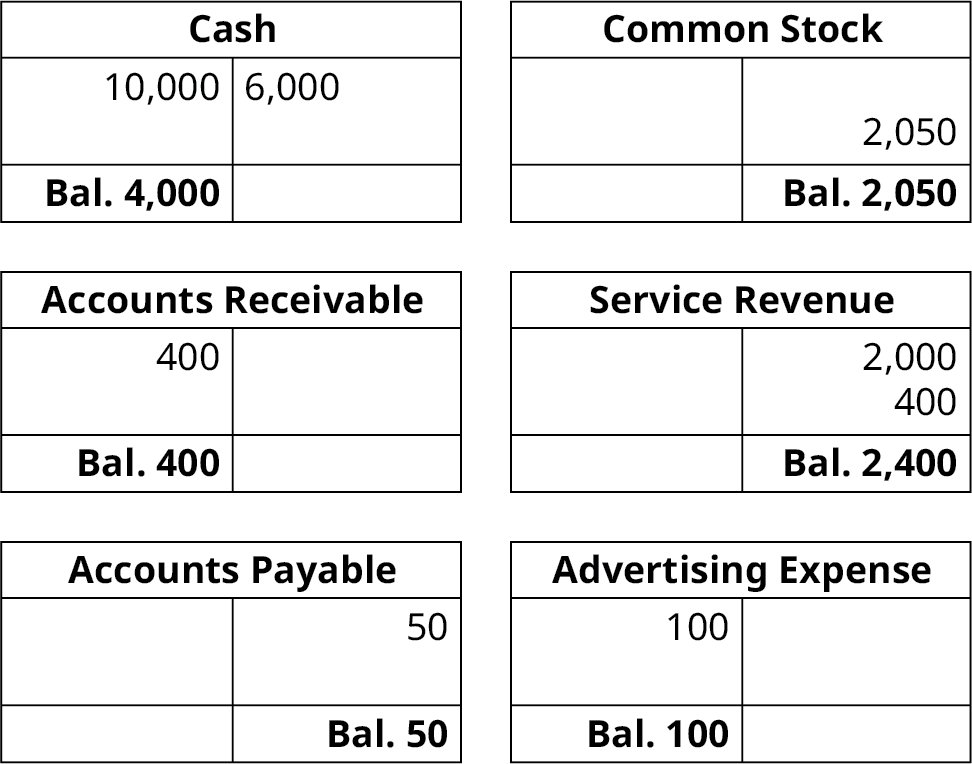

Let'due south now take a look at the T-accounts and unadjusted trial balance for Printing Plus to run into how the information is transferred from the T-accounts to the unadjusted trial balance.

For example, Cash has a final balance of $24,800 on the debit side. This balance is transferred to the Cash account in the debit cavalcade on the unadjusted trial balance. Accounts Receivable ($1,200), Supplies ($500), Equipment ($iii,500), Dividends ($100), Salaries Expense ($iii,600), and Utility Expense ($300) besides have debit final balances in their T-accounts, then this data will be transferred to the debit column on the unadjusted trial balance. Accounts Payable ($500), Unearned Acquirement ($4,000), Common Stock ($20,000) and Service Revenue ($ix,500) all take credit last balances in their T-accounts. These credit balances would transfer to the credit column on the unadjusted trial balance.

Once all balances are transferred to the unadjusted trial balance, nosotros will sum each of the debit and credit columns. The debit and credit columns both total $34,000, which ways they are equal and in balance. However, just because the column totals are equal and in balance, we are still not guaranteed that a mistake is not present.

What happens if the columns are not equal?

Enron and Arthur Andersen

One of the most well-known financial schemes is that involving the companies Enron Corporation and Arthur Andersen. Enron defrauded thousands by intentionally inflating revenues that did not exist. Arthur Andersen was the auditing firm in accuse of independently verifying the accurateness of Enron'due south financial statements and disclosures. This meant they would review statements to make certain they aligned with GAAP principles, assumptions, and concepts, among other things.

It has been alleged that Arthur Andersen was negligent in its dealings with Enron and contributed to the collapse of the company. Arthur Andersen was brought up on a charge of obstruction of justice for shredding important documents related to criminal actions by Enron. They were found guilty only had that conviction overturned. However, the damage was done, and the company's reputation prevented it from operating every bit it had.i

Locating Errors

Sometimes errors may occur in the accounting process, and the trial residuum can make those errors apparent when it does not residuum.

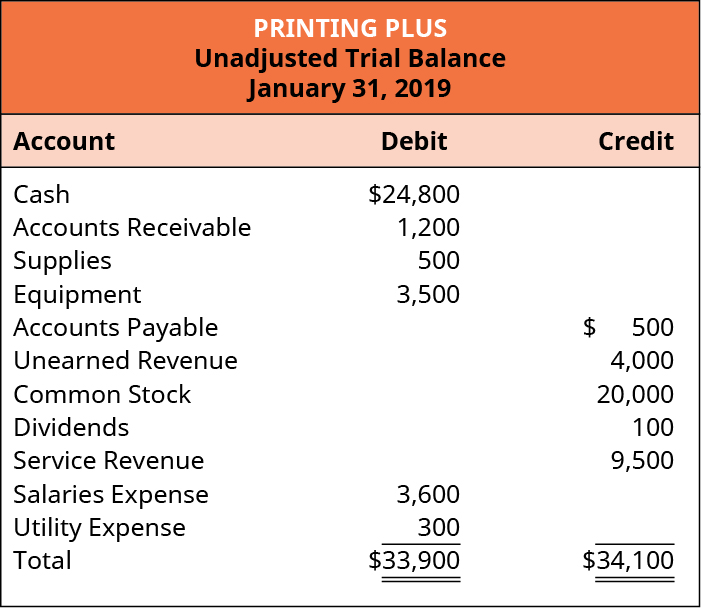

I mode to notice the fault is to accept the divergence betwixt the two totals and divide the difference by two. For example, let's assume the following is the trial remainder for Press Plus.

You notice that the balances are not the aforementioned. Notice the departure between the 2 totals: $34,100 – $33,900 = $200 difference. Now dissever the difference by 2: $200/2 = $100. Since the credit side has a higher full, await advisedly at the numbers on the credit side to run into if any of them are $100. The Dividends account has a $100 figure listed in the credit column. Dividends normally have a debit residuum, simply hither it is a credit. Look back at the Dividends T-account to see if information technology was copied onto the trial residuum incorrectly. If the reply is the aforementioned as the T-account, then trace information technology back to the journal entry to bank check for mistakes. Y'all may discover in your investigation that y'all copied the number from the T-account incorrectly. Ready your error, and the debit total volition go up $100 and the credit total down $100 then that they will both now be $34,000.

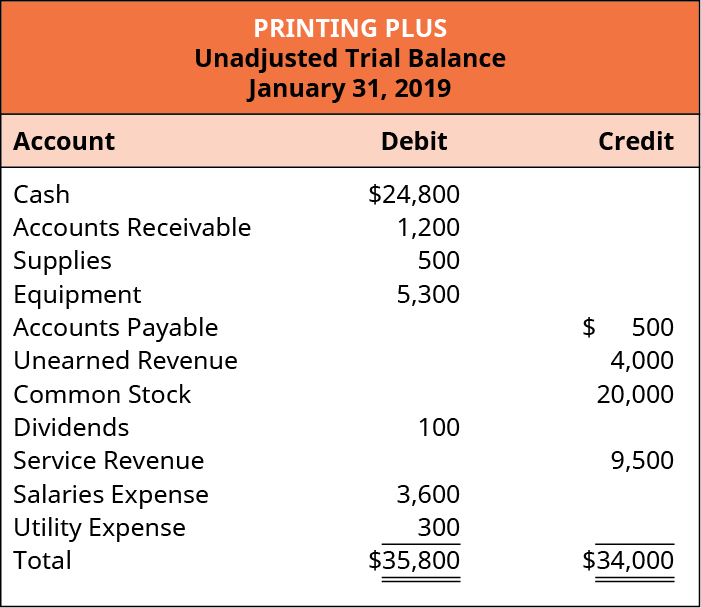

Another way to notice an mistake is to have the difference between the two totals and divide past nine. If the outcome of the difference is a whole number, then you may have transposed a figure. For example, allow's assume the following is the trial residuum for Printing Plus.

Find the divergence between the two totals: $35,800 – 34,000 = $1,800 difference. This difference divided past 9 is $200 ($one,800/nine = $200). Looking at the debit column, which has the college total, we determine that the Equipment business relationship had transposed figures. The business relationship should be $3,500 and non $5,300. We transposed the iii and the five.

What do you do if yous have tried both methods and neither has worked? Unfortunately, y'all will accept to go back through ane step at a time until you find the mistake.

If a trial balance is in rest, does this mean that all of the numbers are correct? Not necessarily. Nosotros can take errors and yet be mathematically in balance. It is of import to become through each step very carefully and recheck your piece of work often to avoid mistakes early on in the process.

Afterwards the unadjusted trial residuum is prepared and information technology appears error-free, a company might wait at its fiscal statements to get an thought of the company's position before adjustments are fabricated to certain accounts. A more complete picture of company position develops after adjustments occur, and an adjusted trial residuum has been prepared. These next steps in the accounting cycle are covered in The Adjustment Procedure.

Completing a Trial Residual

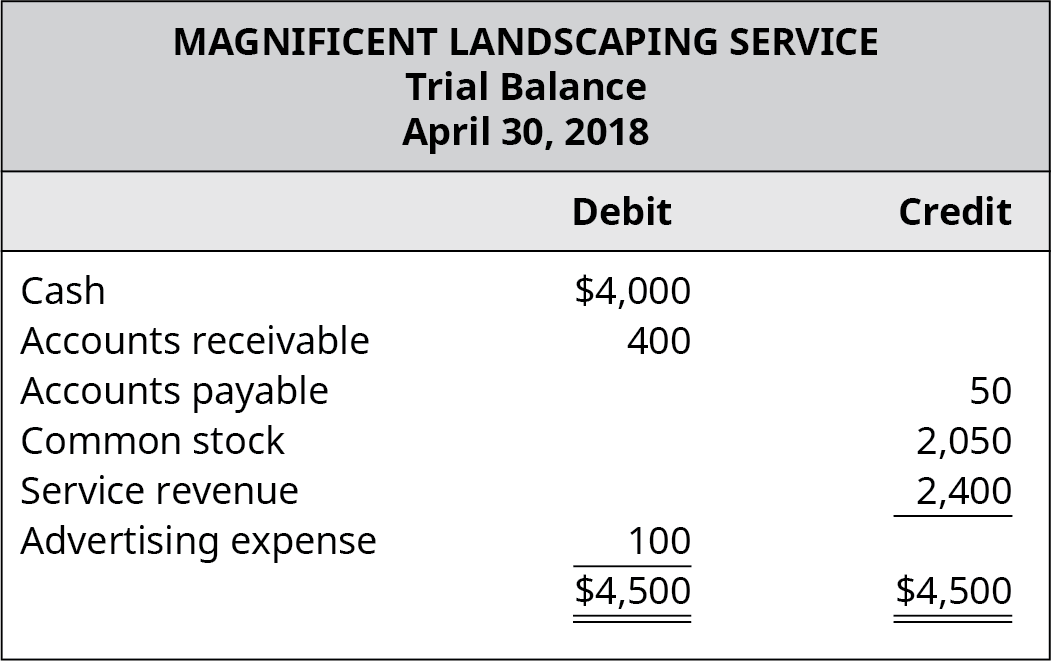

Consummate the trial balance for Magnificent Landscaping Service using the following T-account final residuum information for April 30, 2018.

Solution

Correcting Errors in the Trial Remainder

You lot own a small consulting business. Each calendar month, y'all prepare a trial balance showing your company'southward position. After preparing your trial residue this calendar month, y'all detect that it does non balance. The debit column shows $2,000 more than dollars than the credit column. You decide to investigate this error.

What methods could you use to observe the mistake? What are the ramifications if you exercise not detect and fix this error? How tin yous minimize these types of errors in the future?

Fundamental Concepts and Summary

- The trial balance contains a list of all accounts in the general ledger with nonzero balances. Information is transferred from the T-accounts to the trial balance.

- Sometimes errors occur on the trial balance, and in that location are ways to find these errors. One may have to become through each footstep of the accounting process to locate an mistake on the trial residue.

Practise Set A

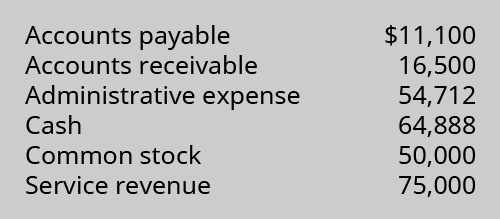

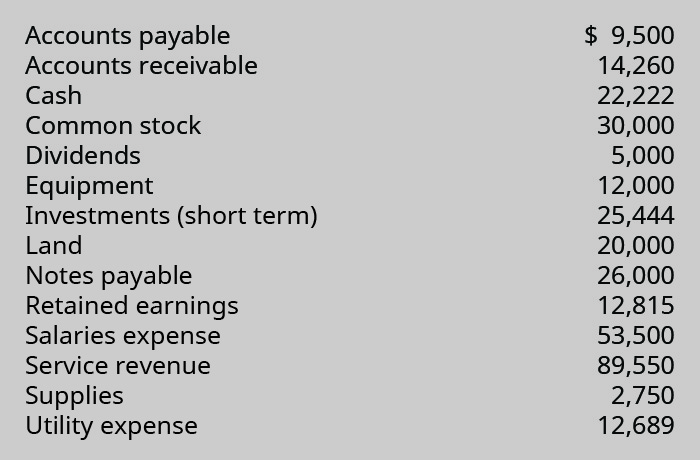

(Figure)Prepare an unadjusted trial rest, in correct format, from the alphabetized account information as follows. Assume all accounts have normal balances.

Exercise Set up B

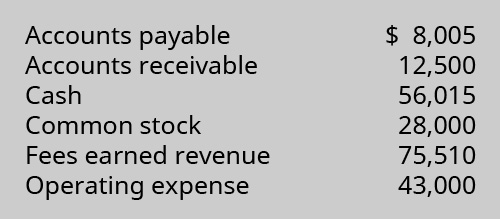

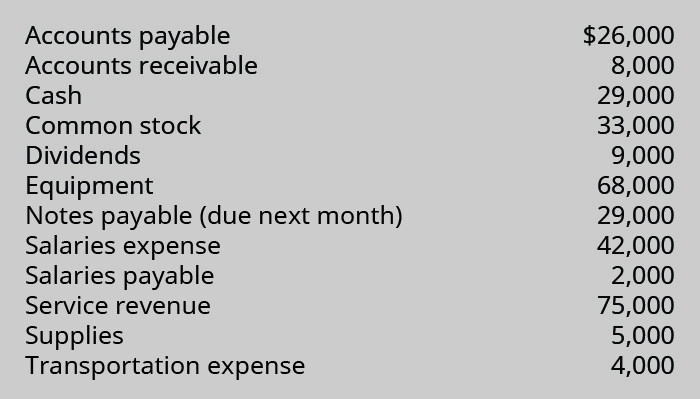

(Figure)Gear up an unadjusted trial residual, in correct format, from the alphabetized account information as follows. Presume all accounts have normal balances.

Problem Gear up A

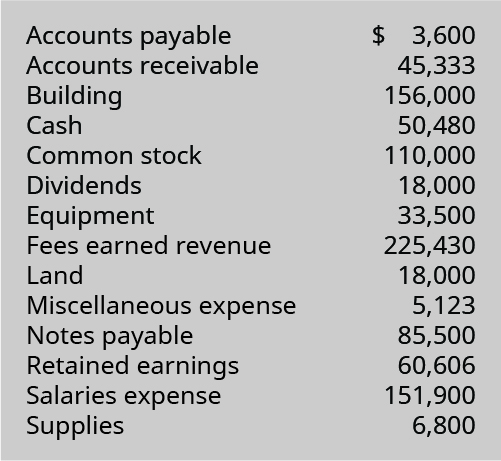

(Figure)Prepare an unadjusted trial residue, in correct format, from the following alphabetized business relationship information. Assume accounts have normal balances.

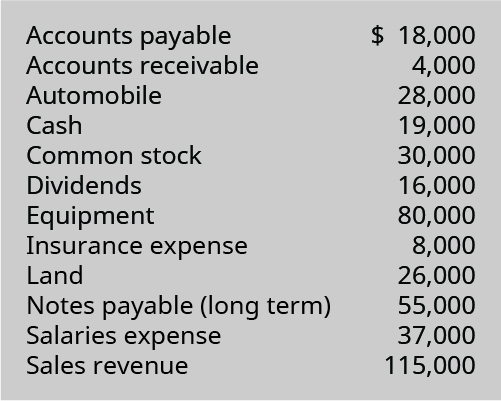

(Figure)Prepare an unadjusted trial residue, in correct format, from the following alphabetized account information. Assume all the accounts have normal balances.

Problem Set B

(Figure)Prepare an unadjusted trial balance, in correct format, from the following alphabetized account data. Assume all accounts have normal balances.

(Effigy)Set up an unadjusted trial balance, in correct format, from the post-obit alphabetized account data. Presume all accounts accept normal balances.

Thought Provokers

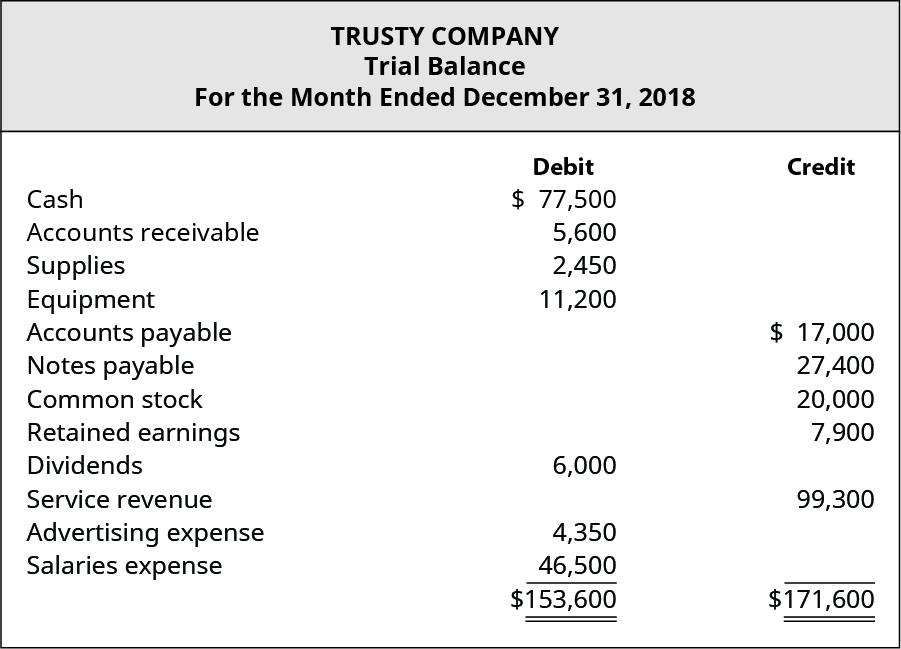

(Effigy)Analyze Trusty Company's trial balance and the boosted information provided to determine the post-obit:

- what is causing the trial balance to be out of balance

- whatever other errors that require corrections that are identified during your assay

- the issue (if any) that correcting the errors volition take on the bookkeeping equation

A review of transactions revealed the following facts:

- A service fee of $xviii,000 was earned (just not yet collected) by the end of the catamenia merely was accidentally non recorded as revenue at that time.

- A transposition error occurred when transferring the account balances from the ledger to the trial balance. Salaries expense should accept been listed on the trial rest as $64,500 but was inadvertently recorded every bit $46,500.

- Two machines that cost $9,000 each were purchased on account but were not recorded in company accounting records.

Footnotes

- 1 James Titcomb. "Arthur Andersen Returns 12 Years after Enron Scandal." The Telegraph. September 2, 2014. https://www.telegraph.co.uk/finance/newsbysector/banksandfinance/11069713/Arthur-Andersen-returns-12-years-after-Enron-scandal.html

Glossary

- trial balance

- list of all accounts in the general ledger that have nonzero balances

- unadjusted trial balance

- trial rest that includes accounts before they take been adjusted

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/prepare-a-trial-balance/

0 Response to "Compute the Balance in Problem 28 Again Assuming That"

Postar um comentário